Part 1: What Does the Inflation Reduction Act Do?

This is the first of a series examining the Inflation Reduction Act and how it will impact the healthcare system, patients, and innovation.

As we prepare for a new year and a new Congress, it is important to look back at the most impactful piece of healthcare legislation passed this year, the Inflation Reduction Act (IRA), and examine how it will affect healthcare going forward.

The controversial legislation included major reforms on taxes, climate, energy funding, and healthcare. CAHC, along with other organizations, actively opposed the healthcare provisions in the IRA as they posed a detrimental impact on the cost of healthcare for all Americans – both on Medicare and those who have private or employer-sponsored coverage. CAHC argued that the legislation kills competition and innovation, leading to higher costs and a decline in new lifesaving drugs while doing nothing to lower inflation.

However, after months of debate, lobbying, and backroom negotiations, the IRA was passed and formally signed into law by President Biden on August 16, 2022. With the implementation of this new law, we must be prepared for dramatic changes to Medicare, ACA subsidies, and drug pricing.

The healthcare provisions passed include:

- Imposing price caps on Medicare Part B and D drugs

- Reforming the Part D benefit and capping out-of-pocket costs

- Imposing rebates on price increases greater than inflation

- Limiting beneficiary out-of-pocket costs for insulin in Medicare to $35 a month

- Creating a new add-on payment for biosimilars in Part B

- Eliminating cost-sharing for certain Medicare-covered vaccines

- Nullifying a Trump-era rule requiring plans to pass rebates on to patients at the pharmacy counter until 2032

- Extending ACA subsidies for higher-income Americans, while making more generous subsidies for lower-income Americans

The IRA was positioned as the solution to reducing healthcare costs for all Americans, but it is really a gutting of Medicare. The most damaging aspect is its elimination of the ban on the government interfering in private sector price negotiations in Medicare Part D. This is a classic DC-style ‘solution in search of a problem.’ Part D consistently delivers high value to seniors, providing choices, low premiums, and consistently coming in under budget projections. A 2020 survey by the Medicare Payment Advisory Commission (MedPAC) found that 88 percent of Medicare beneficiaries ages 65 and older reported being very or somewhat satisfied with the overall quality of their healthcare compared to 82 percent of privately-insured adults ages 50 to 64.

The number one reason for these high satisfaction rates is affordability. While health insurance premiums are going up in 2023 for Americans who receive health insurance through their employer, the Centers for Medicare and Medicaid Services (CMS) reports Medicare premiums are expected to decline in 2023 from $32.08 to $31.50 with nearly 200 plans offering zero-dollar premiums for low-income enrollees.

But those low premiums could soon be a thing of the past as the IRA replaces private plan negotiators, like Cigna, Humana, and CVS Health – some of the country’s most experienced and aggressive drug discounters – with the Department of Health and Human Services (HHS). Taking the power out of the hands of private plan negotiators and giving it to politicians and lobbyists, leaving patients on the sideline. Americans should be afraid. We’ve seen how the government managed COVID and how it deals with the budget – as of now, the government will shut down unless Congress can come to a last-minute agreement by December 16 – how are we supposed to trust that it knows best when negotiating drug prices? The answer is simple, we can’t.

The IRA’s price controls on Part B and D drugs are going to massively impact innovation in the worst way possible. Since Part D’s enactment, more than 550 new products have come to market treating everything from Hepatitis C to cancer. Medicare patients tend to be older and disabled, making the risk for manufacturers significantly higher when developing treatments for diseases like Alzheimer’s, osteoporosis, arthritis, and Parkinson’s. The new price control efforts have a ceiling, but no floor. Manufacturers who refuse the lowball offer from the government will be subject to a confiscatory tax. It’s the government’s way or the highway. Why would a drugmaker risk time and money creating a new drug knowing the government will have the final say on the price? The answer is, they wouldn’t.

The government’s own Congressional Budget Office (CBO) estimates the number of drugs introduced to the U.S. market would decrease by about one over the 2022-2031 period, four more over the next decade, and about five in the following decade. The University of Chicago estimates the price controls will lower research and development spending by up to 60 percent from 2021 to 2039, leading to as many as 342 fewer new drugs. Fewer products on the market lead to less competition and higher costs, the very thing the IRA was supposed to fix.

However, it’s not just name-brand drugs that will suffer. The Association for Accessible Medicines, the trade association for generic drugs, said the price controls “could lead to longer monopolies for expensive brand drugs and reduce patient access to affordable generics and biosimilars.”

Before a biosimilar comes to market, a company has invested hundreds of millions of dollars in planning, development, and coordination with FDA over the course of at least a decade. The IRA allows the launch price of a biologic to be cut by 60%, making the biosimilar more expensive than the reference product. And, since we don’t know which drugs HHS will choose for price negotiations, investing in biosimilars may no longer make sense.

The impact of the IRA is already impacting biosimilars. On October 1, Medicare began paying more for certain biosimilars. CMS must now pay 108% of the cost of the reference biologic, a 2% increase that will be in effect for five years, costing Medicare – taxpayers – millions. So much for affordability. And more changes are coming in 2023.

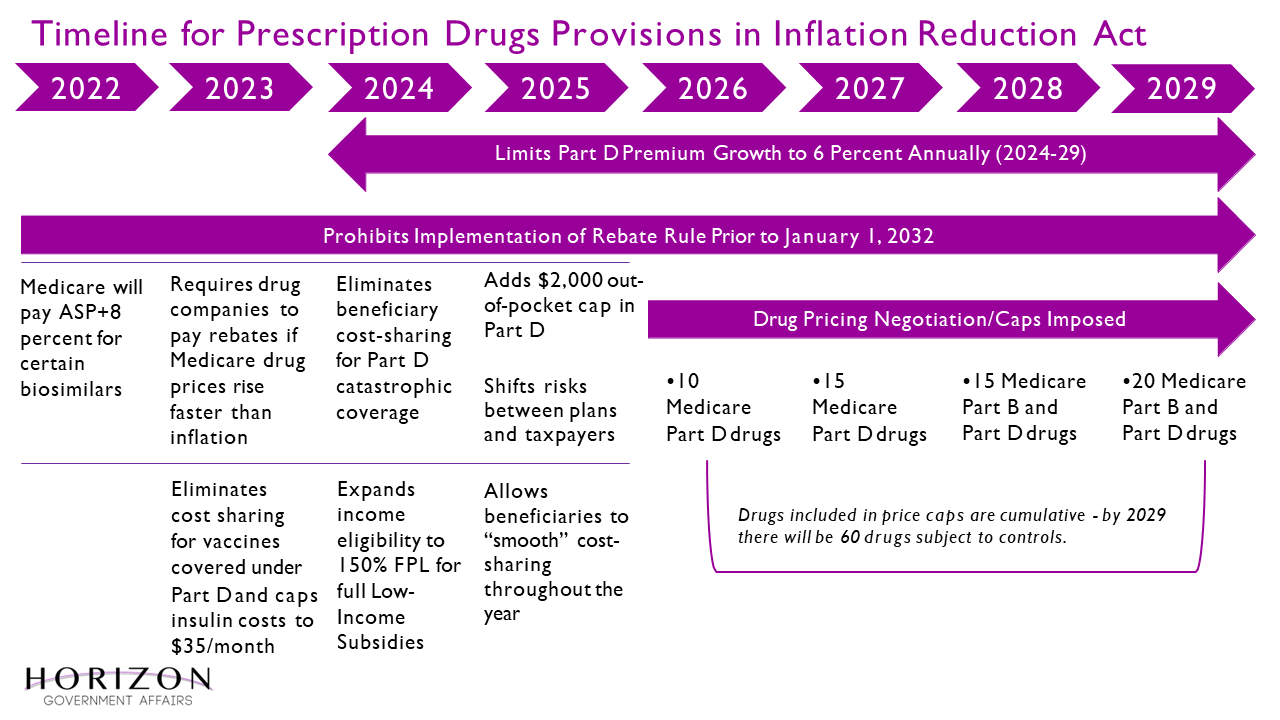

Below is a timeline of when the IRA healthcare provisions are expected to go into effect.

In part two of our examination of the Inflation Reduction Act, we will examine how the law impacts innovation in the drug-making space.